Despite recent military enhancements and rhetoric, there has been an eight-day lull in confirmed incidents in the Red Sea, as reported by UKMTO.

This follows a significant escalation by the Houthis in June, marked by increased attacks and sophistication. The drop in attacks coincides with high-level diplomatic efforts aimed at achieving a ceasefire between Israel and Hamas, whose conflict has now entered its tenth month.

Houthis' Position and Regional Diplomacy

The Houthis, supported by Iranian military intelligence and hardware, have stated their attacks on merchant shipping will continue as long as the conflict between Israel and Hamas persists. Efforts for a ceasefire involve key figures from the US, Israel, and Middle Eastern countries, discussing a three-phase plan proposed by US President Joe Biden. This plan, mediated by Qatar and Egypt, seeks to end the conflict and secure the release of around 120 Israeli hostages in Gaza.

Economic Impact on Shipping

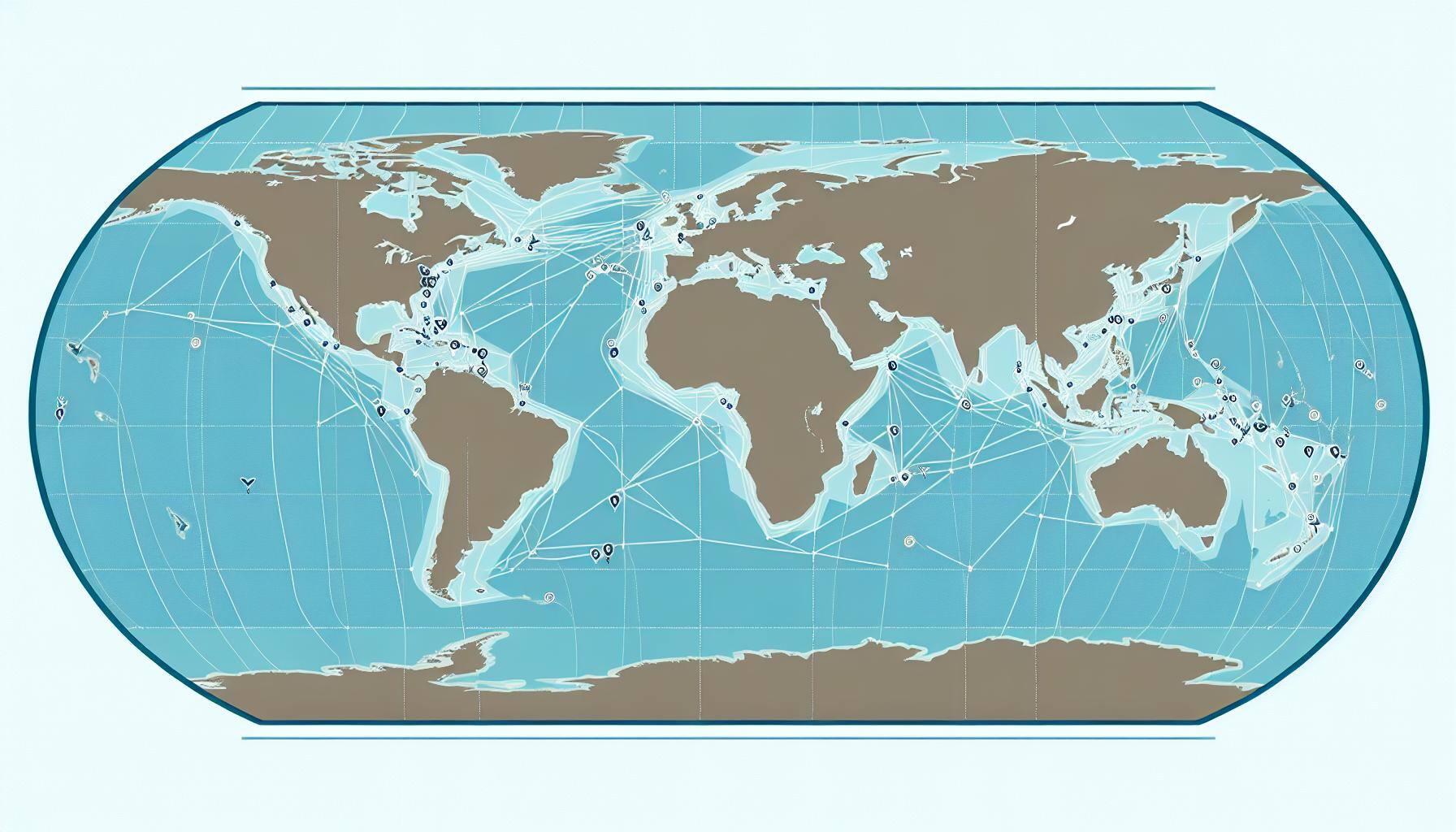

The Red Sea crisis has diverted a large portion of the global merchant fleet away from the Suez Canal, opting for longer routes around South Africa. This has led to a boom in shipping segments, with the ClarkSea Index up 43% above the 10-year trend in the first half of the year. Analysts from Kepler Cheuvreux have assessed the potential impact on rates if the crisis were to end, predicting significant downturns in container shipping, the biggest beneficiary of the current turmoil.

Market Dynamics and Forecasts

Kepler Cheuvreux’s report indicates that 22% of global container shipping volumes have been affected, leading to a 32% increase in the Asia-Europe route distance. This increased demand by 5.6% compared to last December, absorbing fleet growth and raising capacity utilization. However, with a large order book from Asian shipyards, a ceasefire could lead to a 75% drop in spot rates. Other segments like car carriers, product and chemical tankers would also be affected, though crude carriers might experience less impact.

Future Projections

If the Red Sea crisis continues throughout the year, Clarksons Research predicts a record 3,600bn extra tonne-miles, translating to a 5.8% growth. This would surpass the 10-year average significantly. Conversely, if the crisis ends soon, 2024 could still see the second largest increase in tonne-miles on record, following the 2010 post-financial crisis rebound. An end to the crisis could reverse the current trend, limiting tonne-mile expansion.

Humanitarian Aspect

The cessation of the Red Sea shipping crisis would be most beneficial for seafarers and their families, who have faced significant danger over the past nine months due to attacks and hijackings. The broader maritime landscape has been disrupted not only in the Red Sea but also in the Black Sea, Panama Canal, and various drying rivers.

Conclusion

The complex interplay of geopolitical events, maritime security, and global trade presents multifaceted challenges for the shipping industry. Diplomatic efforts towards a ceasefire between Israel and Hamas could potentially alleviate the Red Sea crisis, with significant implications for shipping routes, market dynamics, and the safety of seafarers.

Source: Splash