5 min read

Dryad Global Maritime Intelligence Brief — Week of 22 September 2025

By: Dryad Global on September 24, 2025 at 9:05 PM

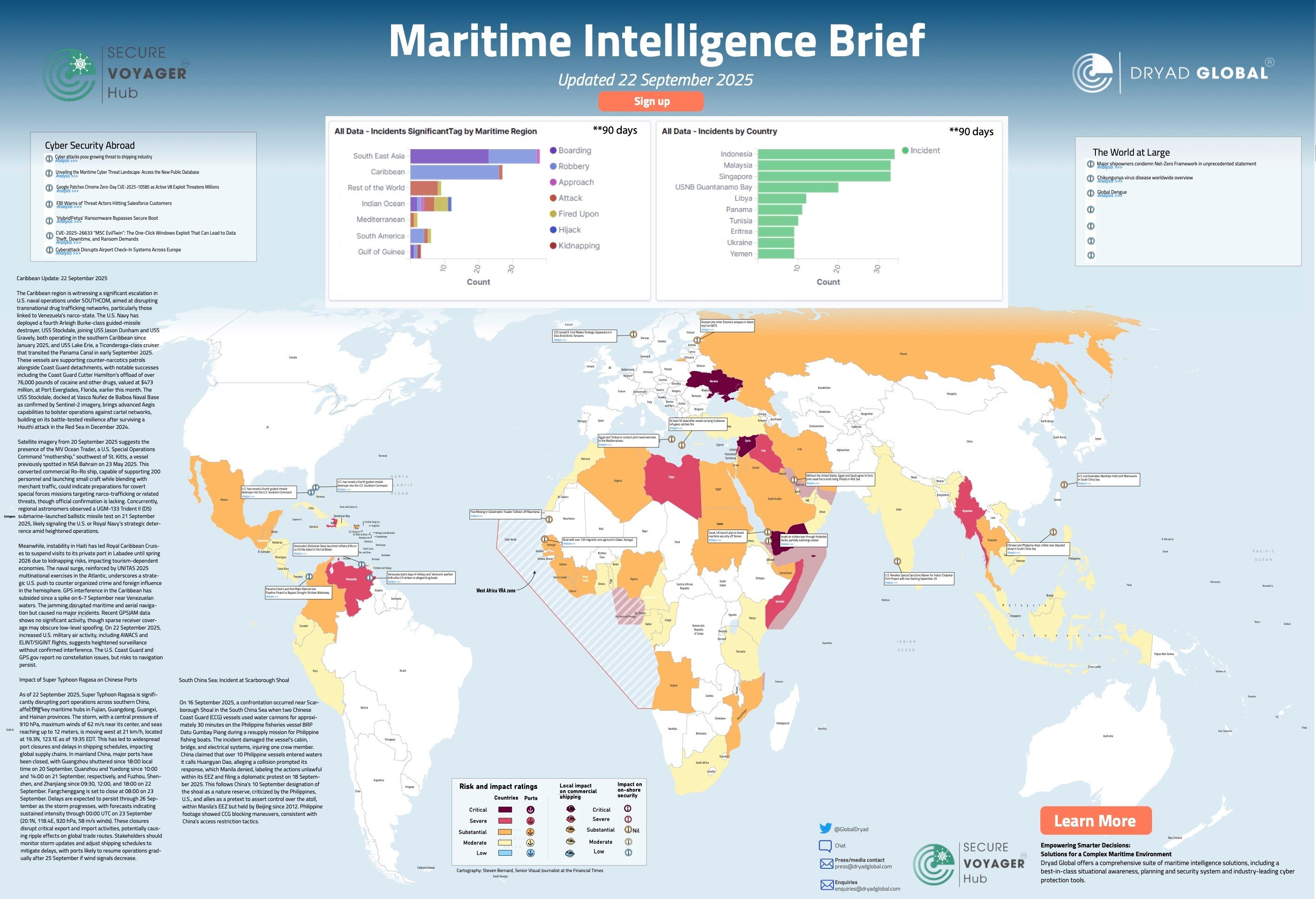

This week’s picture is defined by a U.S. naval surge in the southern Caribbean, major weather-driven disruption across Chinese ports, and renewed tension at Scarborough Shoal. Below we summarise the operational impacts and practical considerations for shipowners, operators, insurers and shoreside teams.

Caribbean: U.S. naval surge, SOF indicators & PNT risk watch

What’s happening: U.S. Southern Command expanded counter-narco operations with a fourth Arleigh Burke–class destroyer (USS Stockdale), joining USS Jason Dunham, USS Gravely and cruiser USS Lake Erie. The U.S. Coast Guard reports substantial interdictions (e.g., Cutter Hamilton offloaded >76,000 lbs of cocaine and other drugs) as part of this push. Sentinel-2 imagery placed Stockdale at Vasco Nuñez de Balboa Naval Base, adding Aegis capabilities to the tasking; note its battle-tested resilience after surviving a Houthi attack in Dec 2024.

Satellite cues from 20 Sept suggest the presence of MV Ocean Trader (a SOCOM “mothership”) southwest of St Kitts—capable of supporting ~200 personnel and launching small craft while blending with commercial traffic—potentially signposting covert counter-trafficking missions (no official confirmation). Regional observers also noted a Trident II (D5) ballistic-missile test on 21 Sept, signalling strategic deterrence amid the uptick in operations.

On the commercial side, instability in Haiti has driven Royal Caribbean to suspend calls to Labadee until spring 2026, underscoring the broader shore-side security environment. Meanwhile, UNITAS 2025 exercises and a brief spike in GPS jamming (6–7 Sept) near Venezuelan waters emphasise navigational resilience needs; recent GPSJAM data shows no current widescale interference, though 22 Sept saw increased U.S. ISR flight activity. USCG and GPS.gov report no constellation issues, but PNT risks persist.

Operator considerations

-

Expect heightened military presence and interdiction activity in the southern Caribbean; comply promptly with hails and keep AIS, comms and documentation in order.

-

Maintain PNT resilience (ECDIS cross-checks, radar/visual fixes, inertial backups) and log any GNSS anomalies via internal reporting lines.

-

Review cruise/ro-ro itineraries touching Haiti and adjacent ports for changes or shore-side risk knock-ons.

East Asia: Super Typhoon Ragasa drives port closures & schedule slippage

What’s happening: Super Typhoon Ragasa (central pressure ~910 hPa, 62 m/s max winds, seas to ~12 m) is disrupting port operations across Fujian, Guangdong, Guangxi and Hainan. By 22 Sept, closures included Guangzhou (since 20 Sept 18:00), Quanzhou (since 21 Sept 10:00), Yuedong (since 21 Sept 14:00), Fuzhou (22 Sept 09:30), Shenzhen (22 Sept 12:00), and Zhanjiang (22 Sept 18:00), with Fangchenggang set to close 23 Sept 08:00. Forecasts indicated sustained intensity through 23 Sept 00:00 UTC (approx. 20.1N, 118.4E, 920 hPa, 58 m/s) and delays likely through 26 Sept, with gradual resumption after 25 Sept if signals ease. Expect ripple effects across global rotations.

Operator considerations

-

Anticipate rollovers and bunching on mainliner/feeder networks; engage early with terminals on berth windows and yard capacity.

-

Re-sequence export ERDs / VGM cut-offs and notify cargo owners of buffer-day requirements and possible force-majeure declarations.

South China Sea: Scarborough Shoal confrontation escalates tensions

What’s happening: On 16 Sept, two China Coast Guard vessels used water cannons for ~30 minutes on BRP Datu Gumbay Piang during a Philippine resupply for local fishing boats; the cabin, bridge and electrical systems were damaged and one crew member injured. Manila filed a diplomatic protest on 18 Sept, rejecting Beijing’s claims that over 10 Philippine vessels entered waters near “Huangyan Dao.” The confrontation follows China’s 10 Sept designation of the atoll as a nature reserve—criticised by the Philippines, U.S. and allies as a pretext for control at a feature within the Philippine EEZ but held by Beijing since 2012. Philippine footage indicates CCG blocking manoeuvres consistent with prior access-restriction tactics.

Operator considerations

-

Maintain safe CPA from contested features; monitor PCG/CCG notices and VHF channels; expect temporary access restrictions and potential water-cannon use in close-quarters situations.

-

Prepare bridge teams for rapid RAS/ROE updates via owners/CSOs when transiting the Luzon/West Philippine Sea approaches.

Quick takes & trend watch

-

Caribbean: SOUTHCOM posture and ISR tempo remain elevated; PNT spoofing/jamming risk is variable—keep cross-checks active.

-

East Asia: Expect schedule disruption at South China coastal ports into 26 Sept with staggered re-openings contingent on wind signals.

-

SCS: Scarborough remains a flashpoint; fishing/support craft face the greatest near-term exposure, but spillover effects can touch commercial shipping.

How Dryad can help

Dryad Global provides a comprehensive suite of maritime intelligence solutions, including a best-in-class situational awareness, planning and security system and industry-leading maritime cyber protection tools—helping operators fuse threat context with route, port and cyber risk decisions. To receive these updates direct, sign up for the Maritime Intelligence Brief and speak with our team about integrating intelligence into voyage and security workflows.

Related Posts

Continuing Rise in Robbery on Ships in Asia in..

ReCAAP ISC, the regional cooperation to combat incidents against shipping in Asia, issued its..

Maritime Intelligence Brief – 17 November 2025

Black Sea escalation, Hormuz tension, and rising pressure in the East China Sea. Commercial..

Dryad Global Maritime Security Threat Advisory..

As global tensions continue to shape the maritime security landscape, this week’s Dryad Global..