Key developments in maritime security, cyber threats, and global shipping risks

As geopolitical tensions, organised crime, and cyberattacks continue to shape the global maritime environment, Dryad Global’s latest Maritime Intelligence Brief provides critical insights for shipping companies, port operators, insurers, and maritime security professionals.

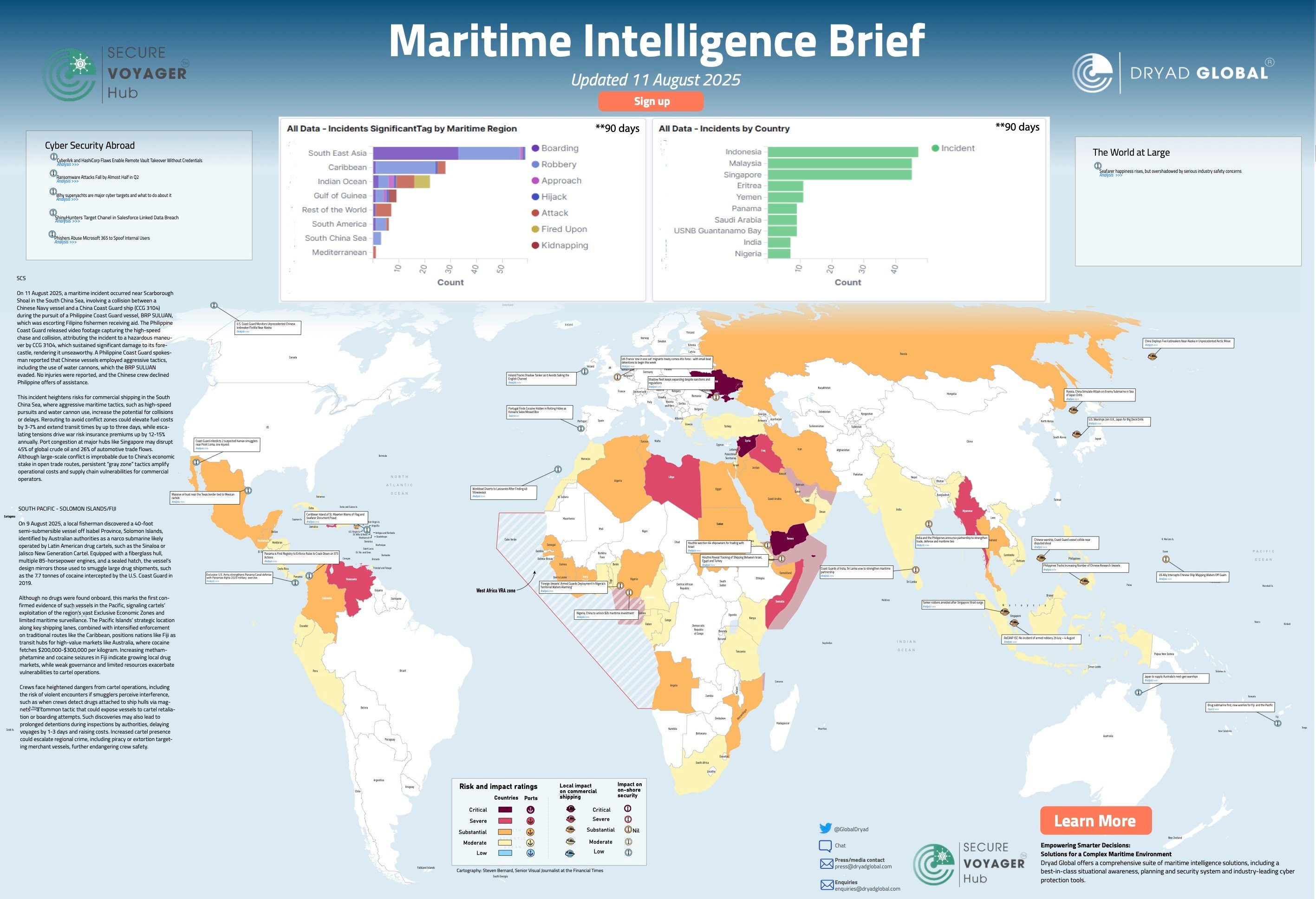

This week’s brief covers two major developments – a high-risk confrontation in the South China Sea and the first confirmed narco-submarine find in the South Pacific – alongside a snapshot of evolving piracy, cyber, and regulatory threats worldwide.

1. Houthi rebels increase Maritime operations

Iranian-backed Houthi rebels have intensified attacks on vessels linked to Israel, the U.S., and U.K. in the Red Sea region, sinking ships and kidnapping crew.

In July 2025, they threatened 64 companies for violating a blockade of Israeli ports. Since November 2023, they’ve launched 128 attacks, including the July 8 sinking of ETERNITY C. A recent Israeli naval strike targeted Houthi infrastructure. With 10–12% of global trade at risk, maritime operators are urged to reroute, disable AIS, avoid Yemen’s coast, and follow best security practices.

Why it matters for commercial shipping:

While large-scale conflict remains unlikely, continued “grey zone” tactics will drive up operational costs and disrupt supply chains for commercial operators.

Access Secure Voyager Hub now:

2. NATO in the north and Baltic Seas

In August 2025, NATO increased maritime patrols in the North Sea and Baltic Sea to counter Russian aggression and protect undersea infrastructure. As part of the "Baltic Sentry" mission, ships from several NATO countries are conducting anti-submarine operations amid heightened Russian activity, including monitoring the vessel Admiral Vladimirsky.

Oil and LNG tankers face increased scrutiny due to Russia’s shadow fleet and sanctions evasion. This may lead to more inspections, AIS checks, and possible delays, especially near chokepoints like the Danish Straits. While disruptions are minimal so far, NATO’s military presence could impact commercial shipping transit times.

Why it matters for maritime security:

-

Potential fuel cost rises of 3–7% from rerouting

3. Other Notable Intelligence This Week

-

Black Sea Task Force to Clear Mines Expands

-

Mexico extradites 26 cartel members to U.S., including top drug trafficking leaders

-

Kenya advances plans for maritime security information hub

-

U.S Deploys Two Warships In Disputed South China Sea After Chinese Ships Collision

-

Coal Blast Rocks Bulk Carrier Off Baltimore

-

Norway Blames Pro-Russian Hackers for Dam Cyberattack

What This Means for the Maritime Industry

This week’s developments highlight the multi-dimensional nature of maritime risk:

-

Geopolitical flashpoints like the South China Sea create physical navigation hazards and increase operational costs.

-

Organised crime is evolving, with narco-submarines now appearing in previously untouched waters.

-

Cyber vulnerabilities and targeted sanctions continue to reshape the regulatory and threat environment.

For shipping companies, operators, and insurers, proactive maritime domain awareness and data-led risk intelligence are essential to protecting assets, people, and supply chains.

📌 Download the Full Maritime Intelligence Brief

Get the complete analysis, incident data, and operational recommendations in Dryad Global’s full report.

👉 Download the full Maritime Intelligence Brief here