The war in Ukraine is the most significant risk event to have disrupted global maritime trade within 2022. The conflict has impacted the shipping industry in several ways, including: restricting freedom of navigation within the Black Sea; commercial disruption with Russia and Ukraine; and having to tackle the burden of sanctions placed on Russia and the associated increase in insurance premiums.

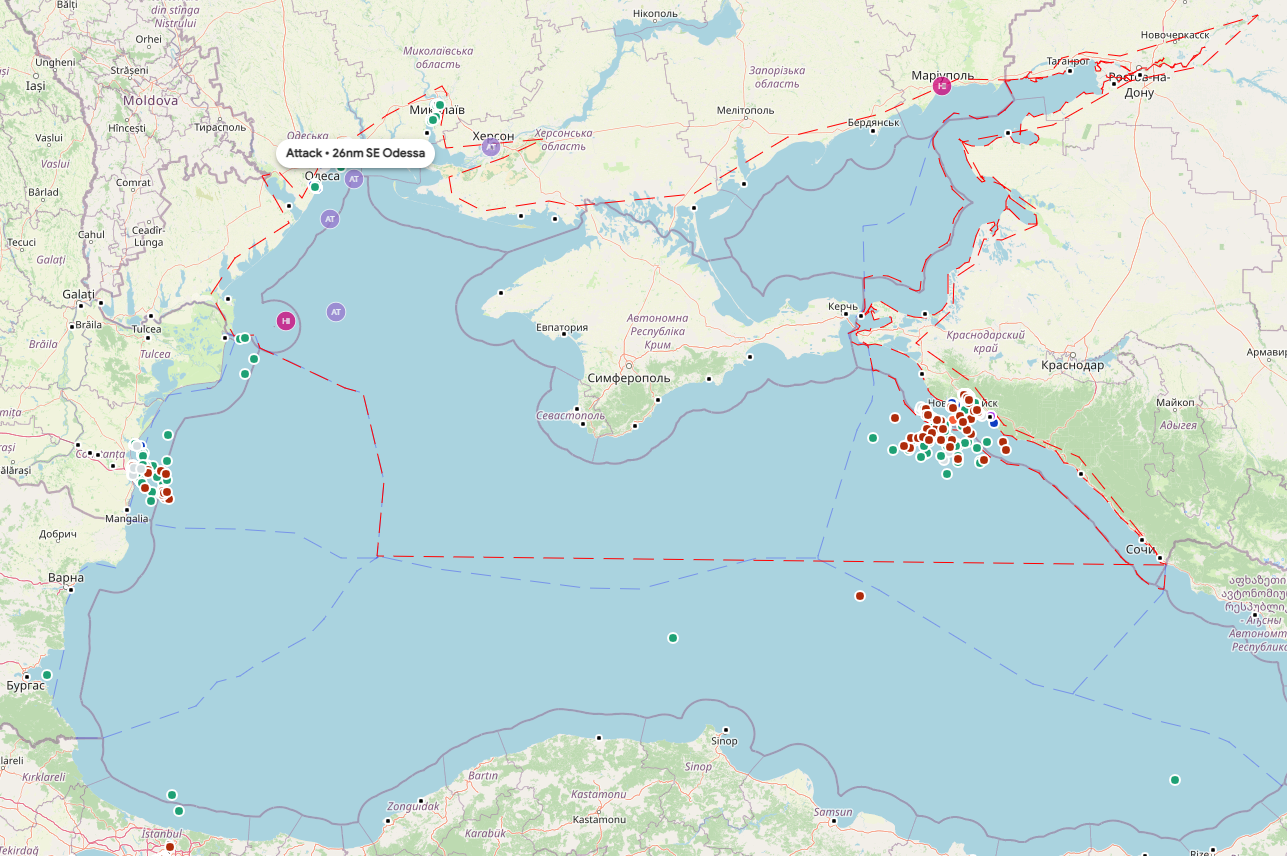

Despite significant limitations on the freedom of navigation throughout the Black Sea, vessels operating in the region and those participating in the UN brokered Grain Deal have been largely unaffected by ongoing military operations. However, vessels continue to face an increased threat from drifting sea mines, geopolitical uncertainty, and increased military traffic. There have been around 50 incidents of drifting sea mines sighted, destroyed, or detonated in the wider Black Sea since the conflict began in 2022, with approximately 30% of these occurring beyond Ukrainian waters.

Ukraine’s main ports were closed from the outset of the conflict. The subsequent UN-supported Grain Deal has facilitated the partial trading of some commodities from the Ukranian ports of Chornomorsk, Odesa Yuzhny. The deal itself, however, has been marred with continued uncertainty concerning its longevity and stability due to Russia regularly signalling its intent to withdraw from the agreement, leading to further commercial ambiguity.

At the onset of the conflict, a large number of vessels were stranded in Ukrainian ports and at anchor, and their crew members were left with no route to leaving the country. Further still, Russian vessels were severely restricted in available port calls, and more than a dozen Russian-owned yachts have been confiscated due to suspicions of violating sanctions. Russian vessels have been deprived of vital maritime services, and some ports have discontinued bunkering facilities for vessels that are owned or flagged by Russia.

As the conflict continues throughout 2023, Russia is proving to be increasingly limited in its available options for furthering its war aims. On shore, Russia is unable to consolidate gains or advance further into Ukraine owing to significant logistical issues. Within the maritime domain, Russia continues with ad-hoc targeting of Ukrainian port infrastructure at those ports not contained within the parameters of the grain deal.

At the current juncture in the conflict, it is apparent that there are likely only two viable courses of action against which events may evolve, neither of which are likely to see a Russian victory in Ukraine. Whilst much depends upon the anticipated Ukrainian counter offensive, there is a realistic possibility that the conflict results in a prolonged state of inertia on both sides. This scenario, inadvertently, may result in a situation where the risk of sudden escalation increases due to a heightened sense of complacency and the threat of miscalculation. If the conflict takes a course where the prospect of a Russian defeat looks more likely Russian military activity may present as increasingly more erratic or desperate. This is likely to be doubly so if the political tide began to turn within Russia itself. In such a scenario, it is a realistic possibility that Russian activity would extend to include substantial operations within the maritime domain, which may result lead to a significantly heightened short-term risk to commercial shipping within the Black Sea. Further still, in such an event, Russia may seek to begin targeting critical subsea infrastructure in areas beyond the Black Sea.

In conclusion, the evolving dynamics of the conflict in Ukraine and the potential ramifications of a Russian military defeat underscore the urgent need for international cooperation and decisive measures to mitigate the risks of escalation and safeguard regional stability.