5 min read

Maritime Intelligence Brief — Week of 15 September 2025

By: Dryad Global on September 19, 2025 at 3:30 PM

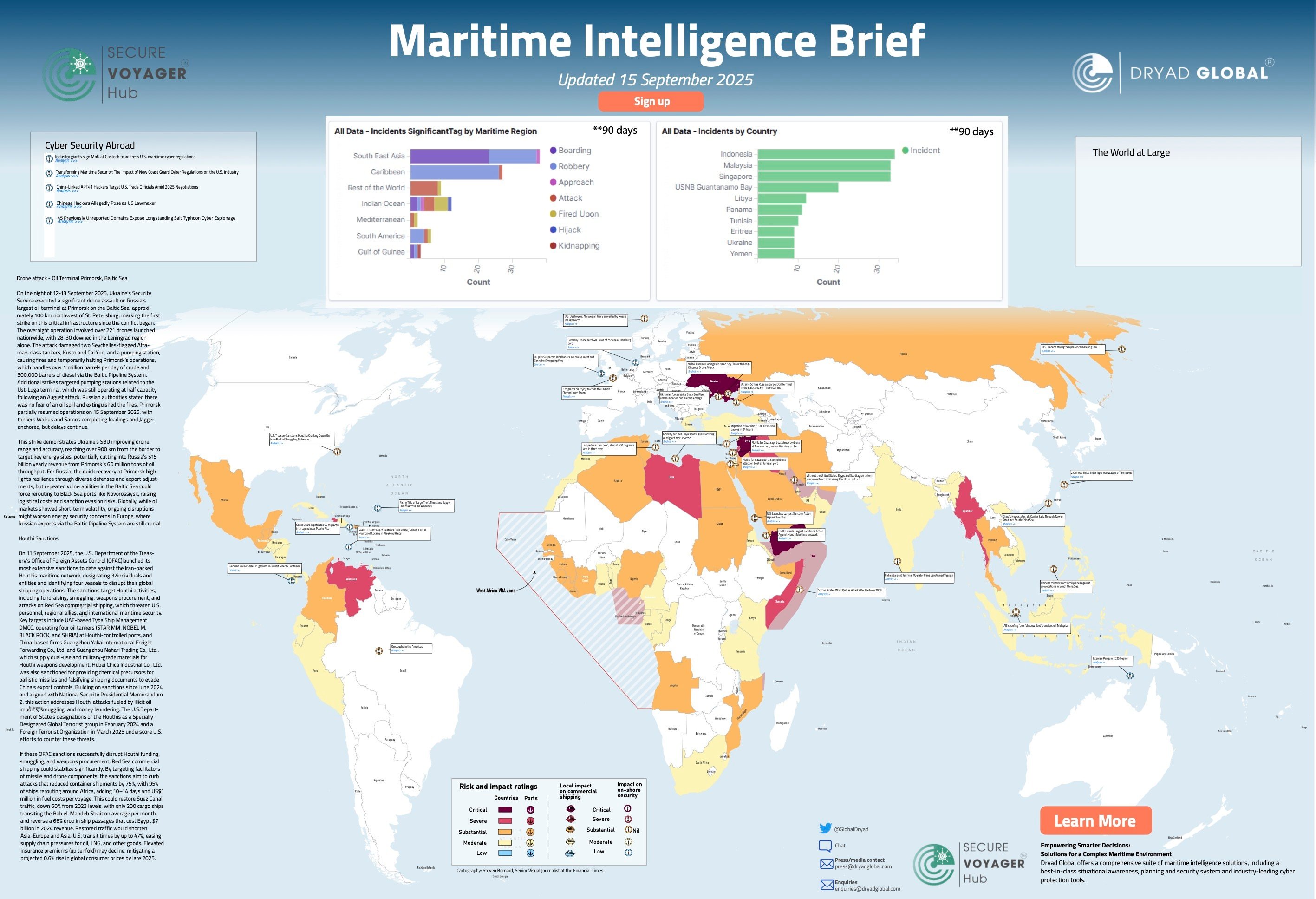

Headline developments this week: a long-range Ukrainian drone strike hit Russia’s largest Baltic oil terminal at Primorsk; the U.S. announced its most extensive sanctions action to date against the Houthi maritime network; and global maritime risk signals spanned cyber operations, piracy trends, migration pressures, and narcotics interdictions.

Baltic Sea: Primorsk oil terminal struck, operations partially resume

What happened: Overnight 12–13 September, Ukraine’s Security Service (SBU) conducted a large-scale UAV operation—221+ drones reported nationwide—with 28–30 shot down in the Leningrad region. The strike reached Primorsk, ~100 km NW of St. Petersburg, in the first known attack on this terminal since the war began. Two Seychelles-flagged Aframax tankers—Kusto and Cai Yun—and a pumping station were damaged; fires halted operations temporarily. Ust-Luga-related pumping stations were also targeted (that terminal had been at half capacity following an August attack).

Why it matters: Primorsk handles ~1 million bpd of crude and ~300,000 bpd of diesel via the Baltic Pipeline System (BPS). The SBU’s ability to strike ~900 km from the border underscores growing range and precision, potentially squeezing an export stream worth ~$15bn/year (c. 60 million tonnes throughput). Russia’s quick partial recovery—Primorsk resumed partial operations on 15 Sept (loadings by Walrus and Samos; Jagger at anchor)—highlights near-term resilience, but repeat hits could force costly rerouting to Black Sea ports (e.g., Novorossiysk) and complicate sanctions-evasion logistics. Expect schedule slippage and localized rate/insurance friction around the Baltic if further attacks occur.

Red Sea: Largest OFAC action yet against Houthi maritime network

What happened: On 11 September, the U.S. Treasury’s OFAC designated 32 individuals/entities and identified four vessels (STAR MM, NOBEL M, BLACK ROCK, SHRIA) to disrupt Houthi-linked global shipping, procurement and financing. Targets include UAE-based Tyba Ship Management DMCC and several China-based suppliers of dual-use materials; Hubei Chica Industrial Co., Ltd. was cited for chemical precursors and falsified shipping documents. The move builds on 2024–2025 designations (SDGT in Feb 2024; FTO in Mar 2025).

Why it matters for trade flows: If sanctions choke finance and supply chains for missiles/UAVs, the Red Sea threat picture could normalize from extreme disruption levels seen since late 2023—container volumes down ~75%, ~95% of ships rerouting around Africa (+10–14 days; ≈US$1m extra fuel per voyage), and Suez transits down ~60% from 2023 (Bab el-Mandeb ~200 cargo ships/month). Egypt’s 2024 canal receipts fell by ~US$7bn; relief would compress Asia–Europe/US transit times (up to ~47% faster), and gradually ease war-risk premia that spiked ~10×—a contributor to a projected ~0.6% uplift in global consumer prices by late-2025. Trajectory now hinges on enforcement and maritime threat response rates.

Cyber & maritime: regulatory pressure and persistent APT activity

The brief flags continued state-linked cyber activity (e.g., China-linked APT41 / “Salt Typhoon” tasking against U.S. trade officials) and the growing compliance burden from new U.S. Coast Guard cyber regulations—topics increasingly intertwined with vessel/port OT security, vendor risk, and documentation readiness. Operators should review incident response runbooks, supplier due-diligence, and regulatory mapping for U.S.-touching voyages.

Regional security snapshot

-

West Africa / Gulf of Guinea: Incident profiles continue to feature approaches, boardings and robberies; kidnap risk remains a watch item even as patterns fluctuate year-to-year. Maintain BMP-aligned procedures, hardened transits, and coastal liaison.

-

SE Asia & Indian Ocean: Petty theft/robbery at anchor and close-quarters approaches endure; masters should reinforce watchkeeping and report promptly to regional IFCs.

(Charts and incident-type breakdowns are available in the full brief.)

The world at large — selected signals

-

High North: U.S. destroyers and Norwegian Navy activities observed under Russian surveillance; U.S.–Canada presence strengthened in the Bering Sea.

-

Mediterranean migration: Lampedusa reports fatalities and hundreds of arrivals; Gavdos logged ~578 arrivals in 24 hours.

-

Transnational crime: UK sentences in a cocaine-yacht / cannabis plot; German authorities seize ~400 kg of cocaine in Hamburg; Panama police intercept drugs from an in-transit Maersk container; U.S. Coast Guard reports 13,000 lb cocaine seizure after destroying a drug vessel.

-

Red Sea / regional posture: Reports of a proposed Egypt–Saudi joint naval force amid Red Sea threats; separate claims of drone activity around Gaza-flotilla vessels near Tunisia contested by authorities.

-

Indo-Pacific tensions: Chinese military warnings to the Philippines; two Chinese ships enter Japanese waters off the Senkakus; China’s newest carrier transits the Taiwan Strait into the South China Sea; India’s largest terminal operator bans sanctioned vessels.

Operational takeaways for owners & operators

-

Baltic planning: Expect berth/line-up delays and short-notice schedule changes around Primorsk/Ust-Luga; review charterparty flexibility and bunkering contingencies if rerouting risk rises.

-

Red Sea routing: Keep dynamic voyage plans in place; track insurer guidance and war-risk endorsements closely as sanctions enforcement unfolds.

-

Cyber readiness: Verify OT segmentation, vendor access controls, and incident reporting pathways for U.S.-touching trades to align with emergent requirements.

-

Port/anchorage security: Maintain vigilant watchkeeping in GoG/SEA anchorages; use regional reporting centres and company drills to reduce response time.

Stay informed

-

Subscribe to Dryad Global’s weekly Maritime Intelligence Brief for full charts, analysis and alerts.

Related Posts

Britain to increase maritime patrols in Strait of..

The British government has pledged to step up defensive maritime patrols in and around the Strait..

Gulf naval developments: on course to face new..

As maritime insecurity escalates in the Red Sea and the Gulf, Gulf Cooperation Council (GCC) navies..

IMO Urges Action to Combat Piracy in Gulf of..

The International Maritime Organisation (IMO) will convene a maritime security working group in..